Fabián Campos is a Business Economist who graduated from the Universidad Metropolitana and is the Coordinator of Scenarios and the Datanálisis Multisectorial Business Survey.

Guacamaya, October 12, 2025. In the prior article, “Strategies of Winning Companies,” we emphasized that the growth of businesses in Venezuela can’t be solely attributed to environmental conditions or their economic sector, but rather their adeptness in implementing strategies. One of these “Winning Strategies” involves securing financing sources.

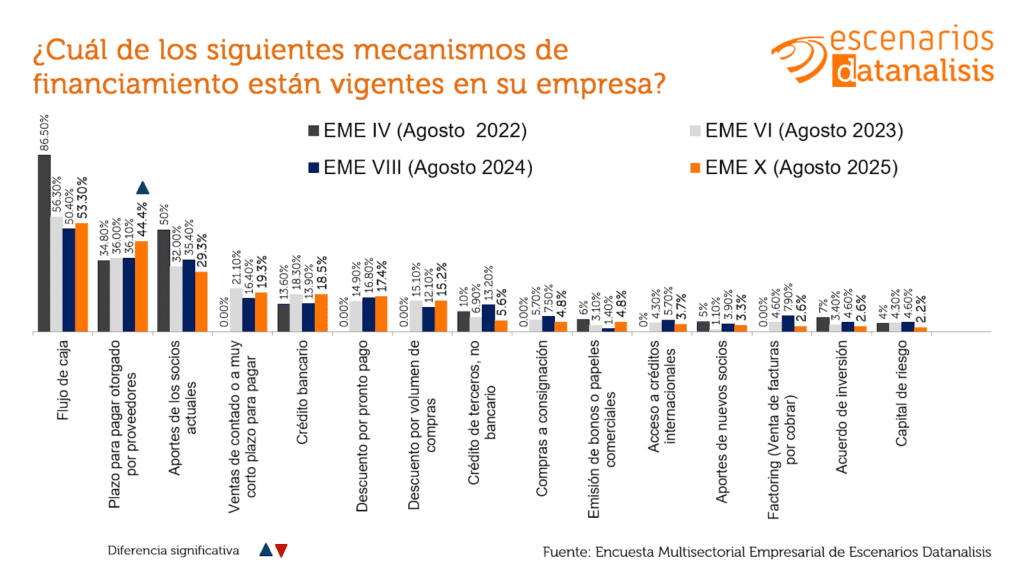

According to the findings from the 10th Datanalisis Scenarios Multisectorial Business Survey, the top three financing methods for companies are: Cash Flow, Payment Terms provided by suppliers, and Contributions from current partners.

While these top three financing mechanisms have remained unchanged since August 2022, analyzing the “number of mentions” yields an intriguing result: The availability of Cash Flow and Contributions from current partners is declining, whereas Payment Terms granted by suppliers are the only financing mechanism that shows a notable increase.

This trend aligns with the characteristics of the Venezuelan economy over the past year, marked by price pressures, gradual devaluations, and a growing exchange rate differential. These macroeconomic factors have diminished business liquidity and solvency (“Cash Flow”) and generated skepticism among economic actors, often deterring internal investment (“Contributions from partners”).

Now, with the financial landscape for Venezuelan businesses laid out, a question arises about the efficacy of “payment terms” as a financing mechanism in an economy where “time is money.” A glimpse into the answer could be found in three other financing methods that have gained traction in Venezuela particularly in the last year: Very short-term sales, Volume purchase discounts, and Early payment discounts.

Coupled with the decline in mentions regarding Cash Flow availability and Contributions from current partners as financing options, a key message appears: businesses in Venezuela are in a liquidity race. Three factors validate this strategy of “financing through liquidity prioritization”: 1. The dynamics of the financial and exchange environment; 2. The scarcity of bank credit (which, despite an increase over the last year, remains under 20% penetration (18.5%) and is concentrated in limited sectors); and 3. The slow economic growth, which negatively pressures customer demand.

But what explains why some suppliers, who are also affected and play by “the same rules,” opt to grant attractive payment terms to their customers? While it might seem counterintuitive, the answer may lie in an alternative strategic approach: differentiation.

Returning to the strategies that define growing companies in Venezuela, “differentiation of the value proposition” stands out as the leading strategy employed in the market. This approach raises an interesting question that we will explore in upcoming articles: What is more effective for Venezuelan businesses today… growing through price/margin or through volume?

Regardless, after analyzing the behavior of more than 1,000 Venezuelan companies over the past three years, we found an 80% correlation between the competitive differentiation approach and increased sales.

Therefore, despite constraints within the economic environment that affect nearly everyone, differentiation in the service offered to customers (e.g., appealing payment terms) may allow some to reconcile potential losses due to exchange rate distortions and devaluation (“price/margin”) with an uptick in their market share (“volume”). Without any tricks or insider knowledge, it’s simply about considering “how can I address a problem for my customer, just as I would wish for it to be addressed for me.” In some cases, “the numbers add up.”

At the Datanalisis 40th-anniversary event on November 4th in Caracas, we will dive deeper into these financing and differentiation strategies within the market alongside our experts.